With Finteo

Your financial status is always under control!

True

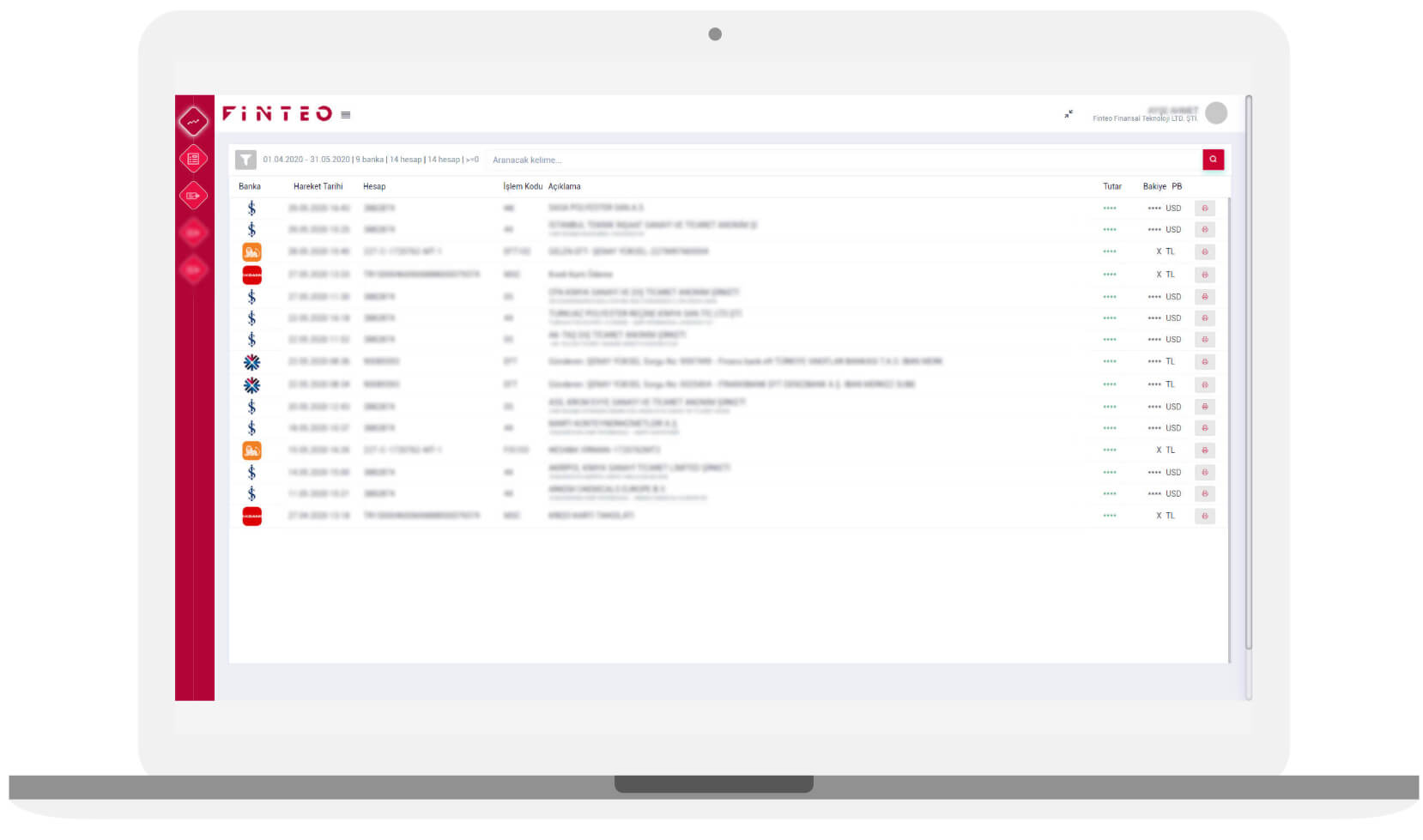

Information flow

The system provides accurate and real-time flow of your data in different bank accounts.

True

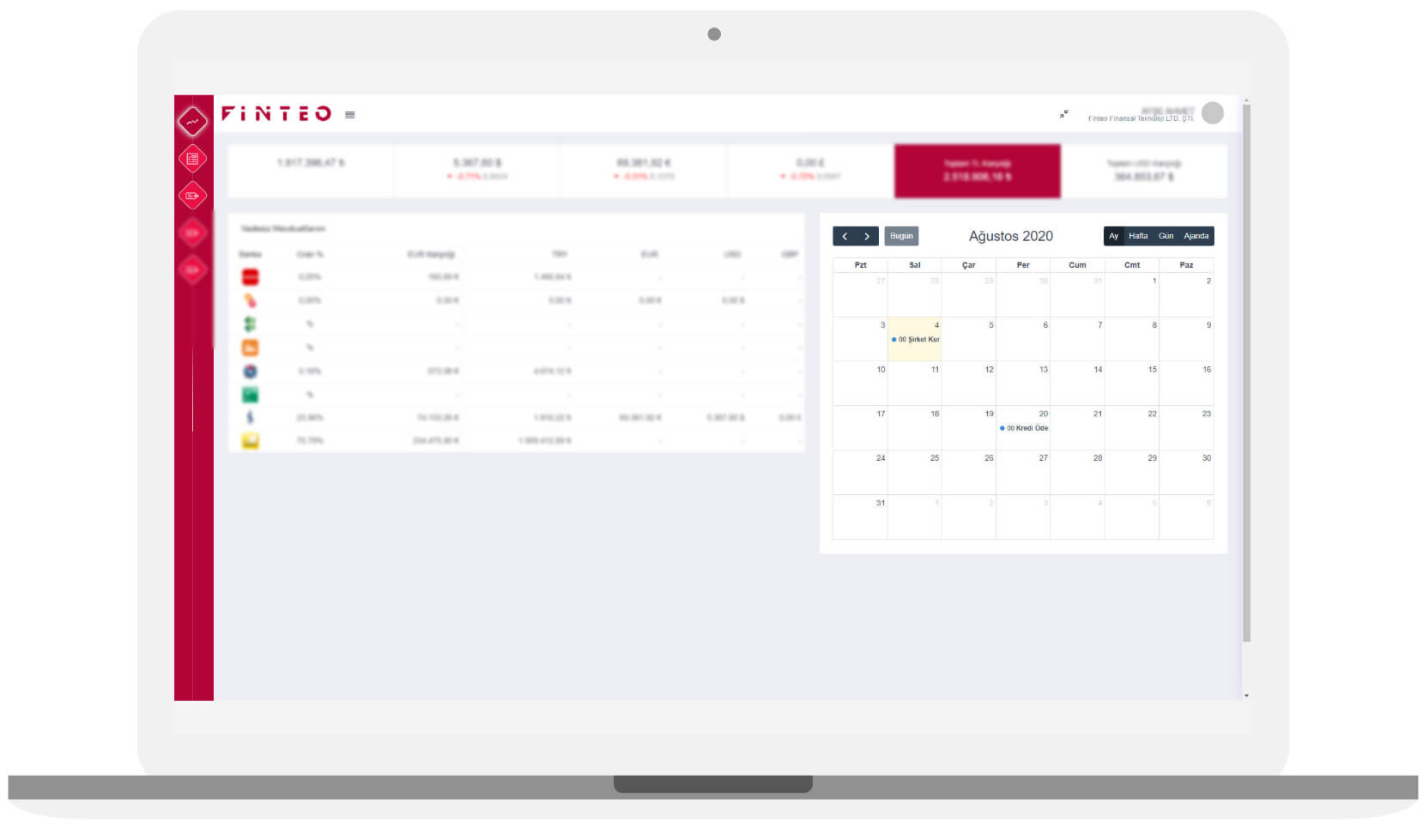

Reporting and Analysis

The system gives an accurate and realistic perspective to your financial structure by combining your data in different formats into one format.

True

Financial Decisions and Management

The system guides you in making the right decisions for your company and financial future with consolidated data.

Open Banking

Open

Banking

Open Banking can be defined as a common platform comprised of secure methods and technologies between financial institutions and Fintechs that allows users to access their financial data with their permission and within the conditions determined in the legal framework.

The driving force of Open Banking is the data economy, and this system enables the customer who owns the data to be in control.

Thanks to this control mechanism, customers can access their financial data more quickly and with a consolidated perspective, as well as decide for themselves with whom and how they want to share their data.

Banks contribute to the development of the financial sector by establishing collaborations to counter changing and diversifying customer demands by generating and sharing customer data in a secure and much more standardized structure.

On the other hand, third party companies, that is us (FINTEO), offer a developing financial technology with faster results by accessing the systems of all banks with the standard interface (API) they have developed and reaching customer data.

In conclusion,

After Internet Banking and Mobile Banking, Open Banking has enabled the financial business conduct of individuals/institutions to become a simple, fast, secure and technological system that is completely under their control.

Blog

Blog

The Future of Open Banking

25-03-2022The term "Open Banking" now represents not just a relationship but a reshaping ecosystem. In the past, the static relationships between banks and customers have become dynamic, and this transformation not only involves two parties and a thi...

Read More

Is Open Banking Safe?

19-01-2022To understand whether open banking is secure or not, we first need to delve into the concept of the Application Programming Interface (API), the secure intermediary that facilitates the implementation of open banking. API, which stands for Applica...

Read More

4 Components of Open Banking

06-12-2021PSD2 and ongoing Open Banking developments around the world clearly demonstrate the rapid progress of this concept. The Open Banking initiatives, which started with the world of payments, have now taken on a new meaning. In general, Open Banking repr...

Read More

What are the Advantages of Open Banking?

05-11-2021The Open Banking system brings transparency, reliability, and many innovations along with it. The most important of these innovations are the software developed by third-party Fintech companies and the APIs developed by banks, known as Application Pr...

Read More

Open Banking in Turkey

04-10-2021Open Banking is a model that allows users to access their financial data through a common platform between financial institutions and fintech companies, under authorized conditions and within a legal framework. It has been on the agenda in our countr...

Read More